Innovative solutions for Investment & Wealth Management

|

Company

P-Strategic Financial Allocation SA, founded in 2009, is based in Lugano, Switzerland. It offers innovative solutions to family offices and financial institutions in terms of product and services to satisfy their customer requirements by effectively supporting investment decisions, portfolio management activity as well as the various regulatory aspects.

|

Key Values

To ensure the highest quality of professional services to satisfy customer's needs and to establish a long-lasting relationship of trust, the company bases its foundations on the following key values.

|

|

Competence

|

| The long and consolidated international investment and risk management experience allowed P-Strategic to internally develop sophisticated proprietary models of risk and performance analysis, strategic allocation and reporting. Our financial expertise, data management and IT skill sets, and our continuous focus on market trends allows us to meet on time new business needs, aligned with latest regulations as well. | |

|

|

Independence

|

| Not related to any bank or other financial institutions to ensure lack of conflict of interests and absolute confidentiality. | |

|

|

Innovation

|

| Models and systems evolve in a timely fashion on the operational needs of the market and on the basis of new regulations and customer expectations. The technical platform is always up to date to guarantee security, performance and speed of implementation of new features. Workflows are designed to meet usability and operational effectiveness. | |

|

|

Quality

|

| We ensure the highest quality of our deliveries and software by designing, developing and testing any feature throughout a well processed interdisciplinary approach. Same "philosophy" is applied to data management and support. Our team is based in Switzerland. | |

Management

|

Giovanni Pagani CEO & Founder

With a degree in physics (ETH, Zurich, Switzerland) as well as in Economics (HEC, Lausanne, Switzerland), Giovanni has a 25 year of investment experience in the financial industry. He has been managing director and senior portfolio manager at UBS. Previously he was global head of Fixed Income quantitative research. He was a member of the Board of Directors of UBS Asset Management in Italy and represented UBS on different committees of other major banks. He is also teacher of finance for CAS, Certificate of Advanced Studies by Università della Svizzera italiana, Lugano Switzerland and for the Master of AIFO, Associazione Italiana Family Officers, Milan Italy.

|

|

Norberto Ronchi Business Director & Partner

After studying at the Faculty of Medicine in Milan, Norberto has gained significant business experience at domestic and international level initially in Sales & Marketing managerial positions moving then to Business Management and to Managing Director roles for the last 10 years. In particular he spent almost 25 years in Reuters with increasing level of responsibilities until he was appointed Managing Director for EMEA West. Since 2008, he was involved, as a partner with business responsibilities, in entrepreneurial initiatives devoting in these his ability to translate business objectives into bottom line results.

|

|

Alessandro Gobbi IT & Software Development Director

|

|

Stefano Da Re Data Integration & Customer Support Manager

|

|

Mattia Ronchi Marketing Manager

|

Specialists

|

Saul Greci Systems Engineer

|

|

Luca Pierini Application Developer

|

|

Tommaso Agugiaro Data Analyst & Customer Support Executive

|

|

Claudio Vielmi Data Analyst & Customer Support Executive

|

|

Solutions

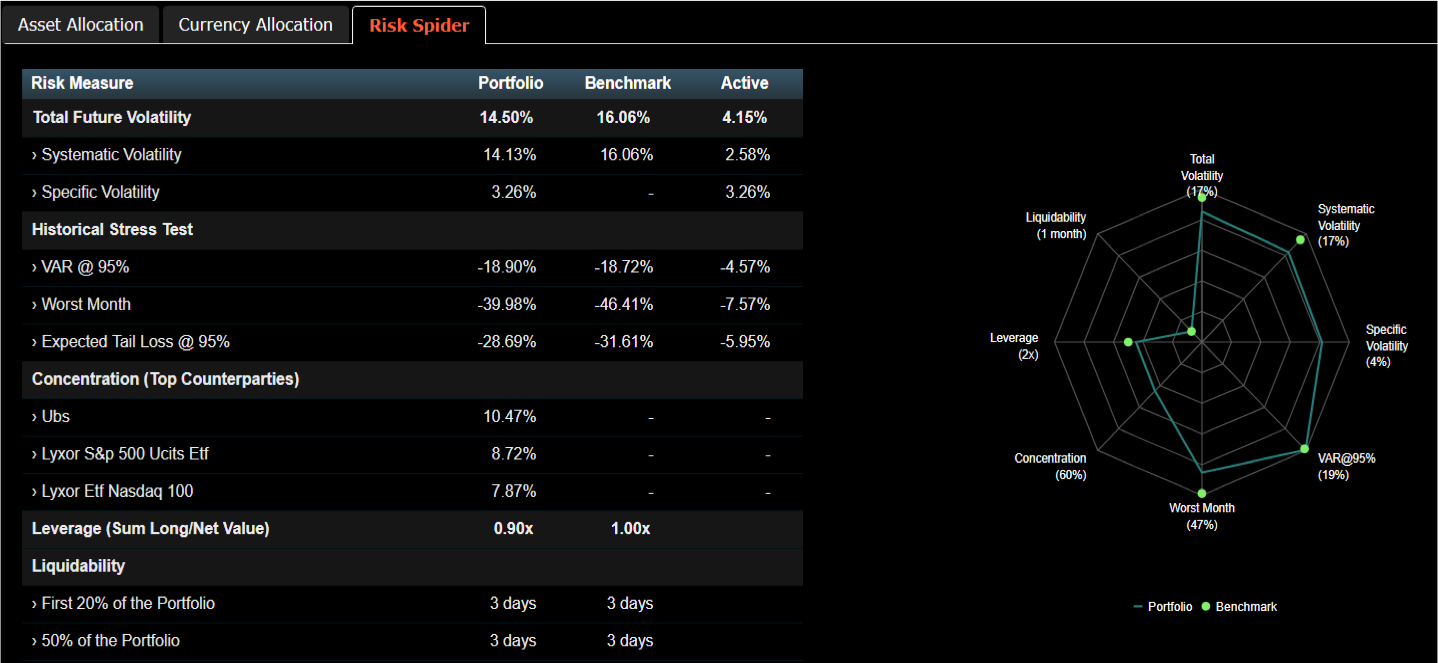

IRIS is an innovative web based service supporting the overall activity of wealth managers, institutional investors and family offices by offering multi asset and client management functionalities, integrated with a complete suite of risk and performance analysis, compliance monitoring and flexible reporting.

|

|

|

Fully integrated

To support both workflows and specific activities within a single tool.

|

|

|

Multiple users

To support the different functions in their daily job.

|

|

|

Easy to use and customize

To improve the effectiveness of the users.

|

|

|

Comprehensive and innovative

To enhance the service to clients.

|

|

IRIS Integrated Workflows

|

Clients

The continuous development of the international financial markets, led to an increase of the wealth complexity of both private individuals and institutions requiring deep analytical capabilities.

|

|

Asset Managers, Family Offices, Wealth Managers, Banks, Foundations & Trusts have specific client or regulatory needs and specific internal workflows across the teams: IRIS efficiently enables such flows of tasks. With IRIS, monitoring the compliance to laws or to guidelines, stress testing market scenarios on portfolio and simulations, aggregate portfolios across banks or even other type of assets like real estate, private equities or art, and produce personalized client report with different level of details, becomes available on-line in a single tool, 24x7 and globally.

|

|

Asset Managers

|

|

” Financial engineering and market complexity require increasingly sophisticated analysis tools: investing, managing risks and understanding performance exceed the "MS Excel" capabilities. Regulations push for more efficient integrated systems. „

|

|

|

|

Family Offices

|

|

” A highly professional and independent global consultancy requires more and more specialized supports to meet the growing needs of our customers. „

|

|

|

|

Wealth Managers

|

|

” Differentiating in the quality of advice is crucial with increasingly demanding customers, without forgetting the growing regulatory duties. „

|

|

|

|

Banks

|

|

” Differentiating in the quality of service offering in an overcrowded industry protects margins and assets under management. The quest for efficiency leads to the integration of multiple services. „

|

|

|

|

Foundations & Trusts

|

|

” An independent and professional financial advice is an effective add-on in the decision process which requires the utmost confidentiality. „

|

|

|

|

|

P-Strategic Financial Allocation SA

Via Pretorio 9 6900 Lugano (CH) Phone: +41 91 912 40 55 Fax: +41 91 912 40 59 |